China’s zero-covid lockdown effect on the global supply chain

24/7 lockdowns, stranded ships and authoritarian politics

What is China’s zero-covid policy?

Shanghai has seen an Omicron breakout, and as a result, the city was locked down. It is the most significant breakout since the Wuhan.

Lorry drivers have special seals on their doors to ensure they stay inside their lorries and do not leave, even to use a toilet. If they break the seal, they cannot get on the motorway.

According to China, the Zero-Covid policy is the only thing that’s currently keeping the whole country from being engulfed by a disease. But, if that happens, the effect would be far worse for China’s and the world’s supply chains.

Chinese vaccines, such as Sinopharm and Sinovac, have a much lower efficacy rate of barely 50%, which is the minimum that countries require to justify national vaccination programs. With such a low efficacy, China cannot rely on containment of the virus spread through vaccination programs.

According to the 2020 census, the Chinese population over the ’60s is 264 million, nearly 19% of the country’s population. These people could potentially face life-ending risks if the virus spreads even more.

China has a near-universal healthcare system; however, it is not so strong that it could handle a country-wide pandemic spread. In addition, healthcare systems worldwide, including China, already face a shortage of personal protective equipment and staff.

Xi Jinping is determined to show the Chinese government system’s superiority that managing a pandemic in an autocracy is better than managing it in a democracy. But unfortunately, he has to see it through, which means a lot of pain for Chinese people and businesses within the country and worldwide.

During the initial pandemic, China employed innovative, specialised and advanced systems to control the spread, including using 5G technologies, extensive data analysis, cloud computing and artificial intelligence. These strategies, together with targeted lockdowns, proved successful when tracking and containing the virus, which is what China is doing again with its zero-Covid policy.

How does the lockdown in China affect Global Supply Chain?

The global supply chain is so complex that the butterfly effects can be constantly seen rippling through a system. So let’s investigate some of those effects.

China locking down the internal transport system and the lack of labour at the ports means challenging times for global logistics, especially sea shipping. The ports are operational; however, there is a shortage of workers to load and unload containers and no lorry drivers to transport goods and raw materials between factories.

As China is the world’s factory, everyone around the world feels it when it stops. Around 60% of goods that are traded around the world come through shipping containers. With the alternative land transport through Russia being closed because of the sanctions resulting from the Ukraine War, the Global Supply Chain faces a massive disruption in its logistics operations.

Air cargo shipping, mainly carried by passenger jets, could be an option; however, it has not yet recovered from the pandemic, so it cannot handle the traffic required to ship goods from manufacturers to distributors worldwide.

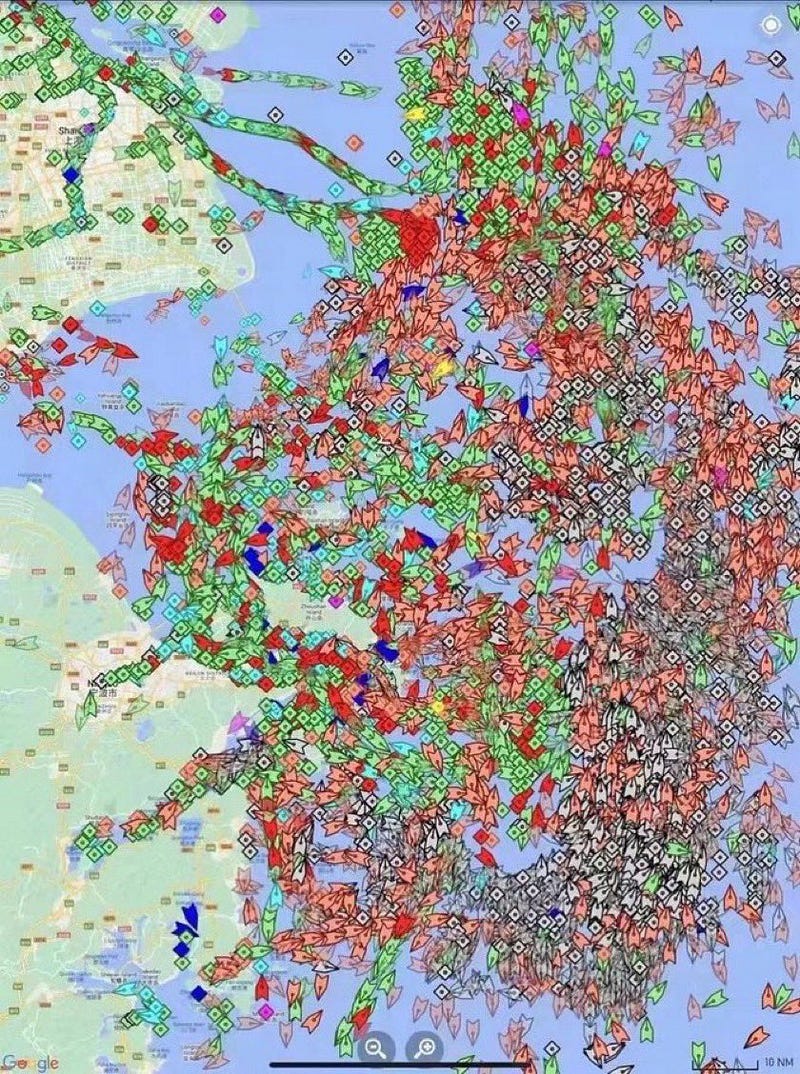

Hundreds of ships were queuing up at the port of Shanghai at the beginning of May 2022. It means that the empty containers aren’t getting inside the ports; they aren’t being loaded and aren’t being shipped to distributors. Due to higher demand for the product and increased logistics costs, even big retailers, such as Amazon, will have to raise prices, which will raise our cost of living.

How mitigate China’s supply shortage and increased shipping costs?

Whilst China is flexing its authoritarian political muscle to prove its governing system’s superiority over democracy in handling critical nationwide issues, we need to start thinking about alternatives.

Nearshoring or even homeshoring could be one of the future strategies, which focuses on sourcing goods or services to produce a product as close as possible to its final selling destination. The drawback could be increased production costs; however, a more expensive product is still way better than no product. The potential of relying less on sea shipping could also be a worthy compromise.

We should look into improving the circular economy of our products. For example, the companies could explore leasing options for their more expensive products rather than selling them to the customer. The strategy benefits the consumer as the seller is responsible for maintaining the product. The manufacturer benefits from a steadier revenue stream and the ability to resell the same product to multiple customers.

Let’s not forget our ultimate product supplier, customer returns. It is a vast source of products that usually need to be minimally touched up so we can reintroduce them into saleable inventory. It can be a bit more complicated when selling electronic goods; however, third-party reverse logistics providers, such as TFix, can help locally.

3PRL company can take care of liaising with customers to return a product, refurbish the product and either return it to the customer, send it back to the fulfilment centre, recover some cost via secondary markets or recycle the product in an environmentally sound way.

Conclusion

China’s new zero-Covid policy put major cities under lockdown, disrupting the Global Supply Chain. In addition, there are hundreds of stranded container ships due to the lack of workers to unload them.

When the world’s factory stops producing and shipping out the products, we feel the ripple effect across the globe. Not only is there a shortage of goods, but the prices are also rising due to the rising cost of sea shipping.

We can look into alternative markets to source the production of our products where the regime is more aligned with our understanding of democracy so that we aren’t so surprised by local government decisions.

Strategies such as developing a circular economy and improving returned goods recycling could also help us decrease the pressure on acquiring newly manufactured products.